In the fast-paced world of trading, where split-second decisions can spell the difference between profit and loss, the advent of market data playback tools has sparked a fierce debate among traders. Are these tools invaluable assets for honing strategies, or are they merely crutches for the lazy? On one hand, proponents argue that playback technology offers an unparalleled opportunity to immerse oneself in historical market movements, allowing traders to dissect and learn from past behaviors in a controlled environment.

They claim that the ability to rewind, pause, and analyze trades can lead to profound insights and ultimately, better decision-making. On the other hand, critics contend that reliance on such tools fosters complacency, replacing the necessity for real-time analysis and instinctual decision-making with a safety net that could undermine a traders growth.

As we delve into this contentious topic, we’ll explore both sides of the argument, dissecting how market data playback may influence efficiency, education, and ultimately, the very essence of trading itself.

The Benefits of Market Data Playback

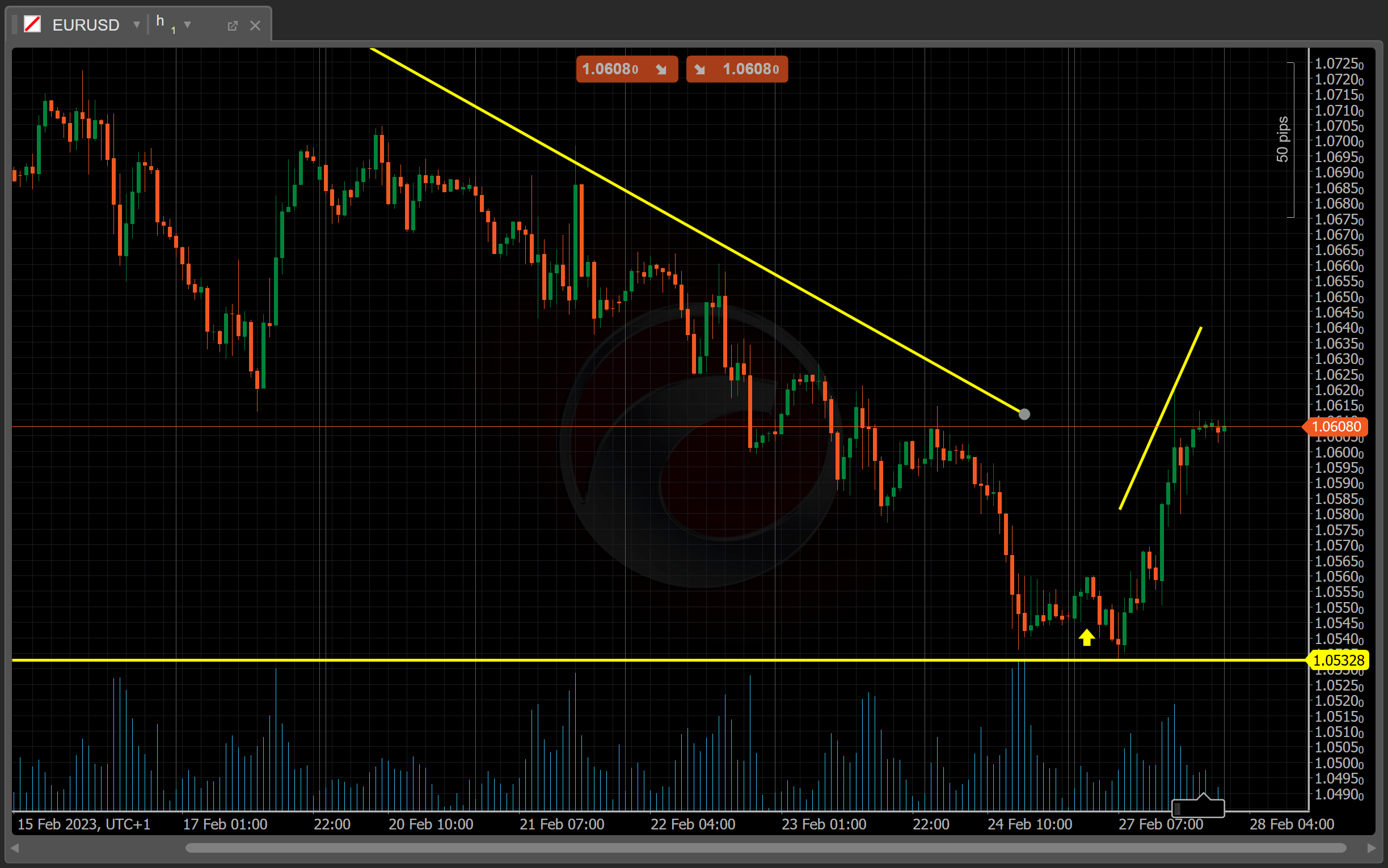

Market data playback offers a treasure trove of benefits for traders seeking to enhance their skills and strategies. Imagine being able to rewind the market to study historical price movements, dissecting every tick and turn with a fine-tooth comb.

This powerful tool allows traders to simulate real-time decision-making without the high stakes of live trades, fostering a deeper understanding of market dynamics and personal trading psychology. Tools like depth of market tool further enhance this experience, offering detailed insights into market depth and order flow to analyze liquidity and support strategic planning. Moreover, it paves the way for invaluable learning experiences; traders can identify mistakes, observe patterns, and refine techniques at their own pace.

Whether one is a novice eager to grasp the fundamentals or an experienced trader fine-tuning advanced strategies, engaging with market data playback can bridge the gap between theory and practice, ultimately cultivating a more disciplined and informed trading approach. In this fast-paced environment, it’s not about being lazy; it’s about maximizing every opportunity for growth and mastery

Arguments Against Market Data Playback

Critics of market data playback assert that relying on this tool undermines the essence of trading acumen, fostering a culture of complacency among traders. Detractors argue that the ability to replay market conditions can create a false sense of security, allowing traders to dissect past scenarios without grappling with the unpredictability of real-time decision-making. It is essential to understand that markets are dynamic; the same circumstances rarely unfold in identical fashion.

By focusing too intently on replayed data, traders may neglect the nuanced interpretation of live market signals, resulting in a rigid approach that stifles adaptability. Furthermore, this reliance on historical data can lead to a superficial understanding of market behavior, where traders treat patterns as rigid templates rather than fluid opportunities that require keen instinct and foresight.

In essence, while market data playback can offer insights, it risks becoming a deceptive crutch, detracting from the essential skills necessary to thrive in the ever-evolving trading landscape.

Balancing Technology and Trading Skills

In the fast-paced world of trading, the interplay between technology and trading skills is both vital and nuanced. On one hand, sophisticated tools like market data playback can provide traders with a wealth of information, enabling them to analyze past performance and refine their strategies accordingly.

Yet, reliance on such technology can foster complacency; it’s crucial for traders to cultivate their own instincts and analytical abilities instead of simply leaning on digital aids. The most successful traders are those who integrate data-driven insights with their own experience and intuition, striking a balance that enhances their proficiency.

Thus, while technology can act as a powerful ally, it should complement rather than replace the foundational skills that define a truly competent trader. Balancing these aspects invites a richer understanding of the market, empowering traders to navigate its complexities with both confidence and acumen.

Conclusion

In conclusion, the debate surrounding market data playback as a potential crutch for lazy traders raises important questions about the nature of trading practices and skills. While some may argue that relying on playback tools diminishes the need for real-time engagement and critical analysis, it is essential to recognize the value these tools can bring to traders at all levels.

By offering a unique opportunity to dissect past market movements, traders can enhance their understanding of market dynamics and refine their strategies. Ultimately, when used judiciously and in conjunction with other analytical tools—such as the depth of market tool—market data playback can serve as a valuable resource that empowers traders rather than enabling complacency.

Balancing this technology with active analysis is key to fostering a deeper, more informed approach to trading in an ever-evolving market landscape.