Choosing the right trading tool can be a challenge. With so many choices, it’s easy to feel lost. Let’s break down the essentials—fees, features, and usability—to make things clear, practical, and even a bit fun. I’ll take you through what matters and what doesn’t, with a few jokes along the way to make things feel less like a tax report and more like a friendly chat.

Key Points

- Fees matter, as they can quietly eat into profits.

- Features vary widely, from educational tools to advanced charting.

- A platform’s ease of use affects how well new and experienced users manage.

- Security and reliability are essential for user confidence.

- Each platform appeals to different kinds of users, so finding the right fit is key.

Overview of Popular Trading Platforms

1. Fees: What Will It Cost You?

Some platforms hit hard with fees, while others keep them low. Fees usually come in three flavors: commission, spreads, and maintenance costs. Most people assume that a platform offering “commission-free” trading has zero fees. Not true. Watch out for spread charges or hidden costs—they can sneak up and shrink your earnings.

Now, let’s put those charges into perspective. Here’s a simple table comparing fees across popular platforms:

| Platform | Commission | Spreads | Maintenance |

| Binomo | Free | Minimal spreads | No fees |

| MetaTrader | Depends on broker | Medium | Sometimes |

| eToro | No commission | Varies | Small fee |

| Robinhood | Commission-free | Varies | No fees |

Each one has its own pricing strategy. New traders might go for lower fees, but experienced users might prioritize more advanced features.

2. Features That Make or Break It

Each platform comes with features meant to enhance your experience. From educational resources to one-click trades, everyone wants to have the latest tools without feeling overwhelmed. For example, Binomo offers unique tools that cater to both beginners and those looking for simplicity. You can even start with a $10,000 demo account to get a feel without the risk. Those looking to get their feet wet appreciate the chance to try things out without real money on the line.

Platforms vary in features like:

- Educational Content: Good for beginners who want a strong foundation.

- Charting Tools: Essential for those who prefer in-depth analysis.

- Mobile Apps: Handy for trading on the go.

- Demo Accounts: Perfect for practice with zero risk.

- Research Reports: Ideal for users who rely on data and insights.

3. Functionality: Can You Use It With Ease?

A trading tool needs to be intuitive. New users, and even some seasoned ones, value a design that helps them find what they need. Some platforms have so many options, users can get lost in the tabs. Others keep it neat and straightforward. It’s all about striking a balance between usability and complexity.

When choosing, ask: Can I navigate this without a tutorial? If not, that platform might not be the best choice, especially if you’re aiming for a straightforward experience.

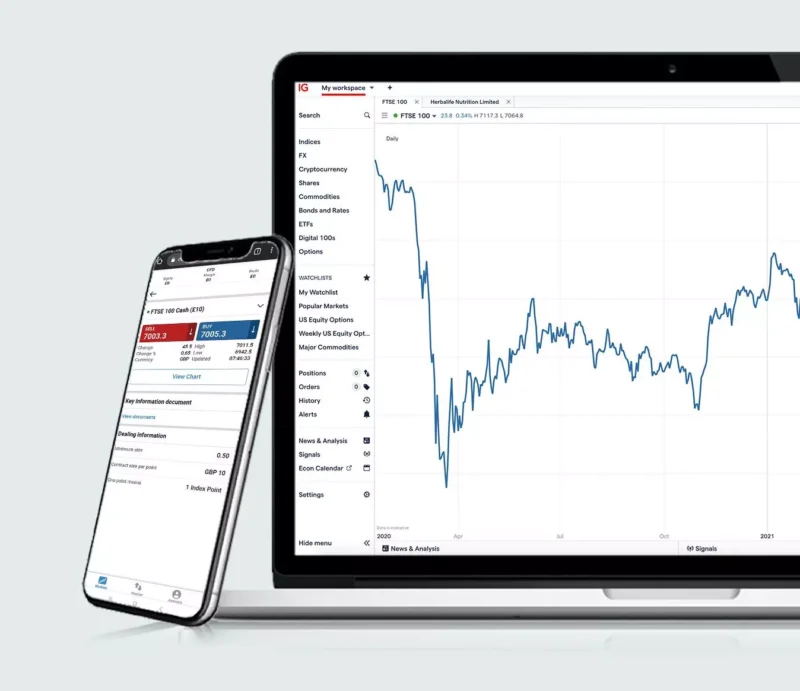

Comparing Platform Types: Desktop, Web, and Mobile Apps

Platforms usually come in desktop, web, or mobile versions. Each type has benefits and drawbacks, and your choice depends on your trading habits.

- Desktop: Good for users who need full functionality and power. Ideal for complex, detailed analysis.

- Web: Perfect for flexibility; log in anywhere with internet access. Many web-based platforms have added advanced charting tools to cater to serious users.

- Mobile: Great for users who want to trade while moving. Just be aware of fewer features and less detail.

If flexibility is important, web and mobile versions usually offer the convenience you’re after. However, if you need in-depth analysis, desktop versions remain superior.

4. Security: Trust Matters

In trading, security isn’t optional. Make sure any platform you consider has solid encryption, two-factor authentication, and good reviews on its reliability. When it comes to security, it’s best to go with well-known names. Each reputable platform ensures that user data stays private and that funds are safe from hacking attempts.

5. Choosing the Right One for You

Let’s keep it simple: Start with a demo account if you’re new. Look for platforms that align with your goals and skill level. If you’re aiming for long-term trading, opt for one with lower fees. If you’re diving into the nitty-gritty of daily trading, you’ll need a platform that emphasizes powerful charting tools.

FAQ

1. What’s a spread, and why should I care?

A spread is the difference between the buy and sell price. It’s how platforms make money, so it impacts how much you keep from each trade.

2. Are demo accounts really useful?

Yes, demo accounts let you practice without real money, giving you a safe place to test strategies.

3. Can I use multiple platforms at once?

Yes, but juggling platforms might feel confusing, especially for new users. Stick to one until you’re comfortable.

4. How safe are online trading platforms?

Most well-known platforms use strong security, but always check if they use encryption and two-factor authentication.

5. Does “commission-free” mean zero costs?

No. “Commission-free” might mean they charge through spreads or other fees, so check the details.

Selecting a platform can be challenging, but a little comparison goes a long way. Look into fees, features, and ease of use—soon you’ll find a reliable tool that matches your needs.